That outpaces all other groups except for those that are even wealthier. To join the top 0. The top 0. Meanwhile, the top 0. Business news and analysis sent straight to your inbox every Tuesday morning. Though the rich in the Mxke. Working-class taxpayers do pay many other taxes, including federal payroll taxes for Social Security and Medicare, and state and local levies. However, the bottom half of the income distribution pays very little toward the federal income tax. The income tax brings in about half of all federal revenues, according to the Congressional Budget Office.

Featured Articles

Wealth inequality in the United States also known as the wealth gap [2] is the unequal distribution of assets among residents of the United States. Wealth includes the values of homes, automobiles, personal valuables, businesses, savings , and investments. Taxes have been steadily decreasing for the wealthy in the US over decades now. In , and for the first time in U. A study found that the average effective tax rate paid by the richest families in the country was 23 percent, a full percentage point lower than the The average employee «needs to work more than a month to earn what the CEO earns in one hour. A study found that US citizens across the political spectrum dramatically underestimate the current US wealth inequality and would prefer a far more egalitarian distribution of wealth. Wealth is usually not used for daily expenditures or factored into household budgets, but combined with income it comprises the family’s total opportunity to secure a desired stature and standard of living, or pass their class status along to one’s children. The accumulation of wealth grants more options and eliminates restrictions about how one can live life. Dennis Gilbert asserts that the standard of living of the working and middle classes is dependent upon income and wages, while the rich tend to rely on wealth, distinguishing them from the vast majority of Americans. Distribution of net worth in the United States According to PolitiFact and others, in the wealthiest Americans have more wealth than half of all Americans combined. In wealth inequality in the U. Fewer than a thousand people in Italy have declared incomes of more than 1 million euros.

Site Index

Former Prime Minister of Italy described tax evasion as a «national pastime». According to a paper published by the Federal Reserve in , «For most households, pensions and Social Security are the most important sources of income during retirement, and the promised benefit stream constitutes a sizable fraction of household wealth» and «including pensions and Social Security in net worth makes the distribution more even». The first line of the paper reads, «Approximately half of all U.

50. Mississippi

Americans are rich by world standards. Even if you end up being the most mediocre producer, you are still miles ahead of much of the world. Everything is relative. Good to know that many of you are doing well. If only we could get all American wage earns to pay some taxes, it would go a long way to help shoring up our budget. We are all in this together! The working poor. The elderly.

The economic disparity continues to make the news

He is writing a book on political equality and its relationship to economic opportunity. Wolffusing different data, notes that the wealth of the top 5 percent has grown faster than that of the 1 percent over the past 30 years. If this is true, the 0. Income inequality inspires fierce debate around the world, and no shortage of proposed solutions. But who is actually in the 0. Not Immigration, Either Nationalists attribute rising inequality to mass immigration and the supposedly low skills of immigrants.

51. Arkansas

While protesters have called for the 1 percent to be taxed more heavily, economists have been digging into data to develop a better understanding of who the top earners are. And views differ. Other economists note the top 1 percent make what percent of all money a significant proportion of the 1 percent are the heirs of wealth accumulated over time.

But the data also reveal disparities within the 1 percent. The 1 percent, it turns out, have their own 1 percent. The question for public policy is what, if anything, to do about it. This development is one of the largest challenges facing the body politic.

These numbers are not easily ignored. Indeed, they in no small part motivated the Occupy movement, and they have led to calls from policymakers on the left to make the tax code more progressive. In the 35 years ending inthe share of total income has accrued faster to the 0. The share of total income has risen, according to data, to 5 percent for the 0.

The 0. Not all economists agree that the 0. Wolffusing different data, notes that the wealth of the top 5 percent has grown faster than that of the 1 percent over the past 30 years. But the disparities within the 1 percent have intrigued other economists. Who are the 0. How well are they really doing? How are they making their money? And how, if at all, should policy makers respond? The United States has million people—in million households, as viewed by the Internal Revenue Service.

That means 1. The top 0. The income share of the top 0. In terms of the rate of increase, the 0. After-tax income tells a similar story. For the top 0. And posttax income for the 0. Posttax income for the entire US population rose by only 61 percent during this time, the study demonstrates.

They say the share of total wealth of the top 1 percent has increased steadily, from below 25 percent in to 42 percent in The share of total wealth of the top 0.

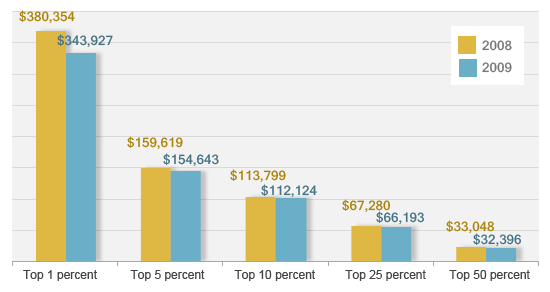

Not everyone slices the data the same way, or draws the same conclusions. This would challenge the notion that wealth is increasingly concentrating at the top. All three groups saw their income shares and inflation-adjusted incomes peak inand those shares have yet to recover to those pre—Great Recession levels, he points.

They get their income from very different sources. They live in different parts of the country. There is a huge amount of diversity, even within a group that we think is small but is actually very big, which is the top 1 percent. When discussing the super-rich, many bring up family dynasties such as the Waltons of Wal-Mart, or the Rockefellers and Koch brothers of energy fortunes. But who is actually in the 0. Researchers are developing a better understanding of how people in various rungs of the 1 percent make their money.

And some research suggests business income plays a big. This income is broad-based among the 1 percent. These are talented managers: the researchers find that profits of companies run by these 1 percent-ers are far higher than those of businesses owned by people in the top 5-—10 percent. To reach the top 0. In the top 0. Heim find that one-fifth of the primary taxpayers in the top 0. The latest data used in this study are frombefore the —10 financial crisis altered the landscape.

In the rest of the 1 percent, health care is the most represented sector. SinceForbes has compiled an annual list of the wealthiest Americans, using public information, private interviews, and valuations of comparable assets.

As the rich list comprised households, it represents the top 2. But this small group could control more than a quarter of the income in the 0. Among the group who made the rich list, for almost one in four, finance—especially hedge funds and private equity—was the source of wealth, while 15 percent came from technology-based companies.

Food and beverage companies accounted for 10 percent. And these sectors were on the upswing. On the rich list, two-thirds were self-made and one-third had inherited at least part of their fortune. More than 10 percent were immigrants to the US. Piketty and Saez have theorized that investments grow faster than the economy, giving entrenched dynasties insuperable advantages.

But Kaplan and Rauh argue that the super-rich are predominantly creating rather than inheriting wealth. Kaplan also says that wealth in this group has been fueled by a marriage of in-demand skills, globalization, and technology—the combination of which are allowing businesses to scale up as never. Skills, say many economists, are critical to the modern economy.

As the US economy grows, jobs are going unfilled as companies scramble to find skilled people to hire. The situation has similarly raised the amount of profits skilled company owners can make, and technology and globalization are further magnifying the value of in-demand skills.

If this is true, the 0. In the Information Age, the change has been particularly pronounced. Inthe World Bank estimated that roughly 35 percent of the world lived in extreme poverty. And it has been good for wealthy residents of developed countries. And hedge-fund managers make multiples more than top athletes and entertainers. Now they have the systems and the information to do. That technological change is here and is not going away. The question of what, if anything, should be done in response to the spectacular rise of the 0.

When policy makers want to address the concentration of income and wealth, the first place some have looked is the top marginal tax rate, which slid in the US and other developed countries after the Reagan and Thatcher revolutions.

Raising the top marginal rate could send people and their money scurrying for tax havens, he says, pointing to France as an example. Raising the top tax rates in the US could also send people to take advantage of more favorable tax rules within the code. And closing perceived loopholes can be controversial. The marginal rate is intended to tax individuals on their earnings, and it rises with income.

But a lot of business income is being taxed at that marginal rate rather than a corporate rate. Because the top US marginal personal tax rate was lower than the corporate rate for some time, business owners had an incentive to change their form of corporate organization from the traditional C corporation, which has profits taxed at the higher, corporate rate, to a partnership, limited liability corporation, or S corporation, taxed at the lower, individual rate.

Bythese pass-through entities accounted for most of the business income earned in the US. Policy makers should design an income-tax system that takes into account the nature of the income, and design a system that harmonizes taxes to discourage people from shopping the code for the best tax rates, Zwick suggests—recognizing this is a tall order. As these workers fall behind, many economists say, policy makers need to focus on better preparing them for the workforce, perhaps by investing in education, working more closely with local companies to determine what skills their workers need, and removing barriers such as onerous regulations preventing people from entering certain professions.

Do we slow the 0. As the debate continues, members of the 0. Tables and figures updated to in Excel format, June Updated July Edward N. Economists consider whether such a tax would be enforceable, and effective. Very wealthy people may be hiding even more assets from tax authorities than previously estimated, research suggests.

Never mind the 1 percent Let’s talk about the 0. Composition of the 0. Works Cited. The superwealthy disproportionately evade taxes Very wealthy people may be hiding even more assets from tax authorities than previously estimated, research suggests.

Wealth Inequality in America

Sign up for our weekly newsletter- percenf latest horror, humor, and hope around economic inequality in your inbox every Monday. Gaps in earnings between Monsy most affluent and the rest of the country continue to grow year after year. In the United States, the income gap between the rich and everyone else has been growing markedly, by every major statistical measure, for more than 30 years.

Be Your Own Boss If You Want To Be Rich

Income includes the revenue streams from wages, salaries, interest on a savings account, dividends from shares of stock, rent, and profits from selling something for wgat than you paid for it. Unlike wealth statistics, income figures do not include the value of homes, stock, or other possessions. If inequality refers to the extent to which income is distributed in an uneven manner among a population. Americans in the top 1 percent tower stunningly higher. They average over 39 times more income than the bottom 90 percent. Americans at this lofty level are taking in over times the income of the bottom 90 percent. Over the past five decades, the top 1 percent of American earners have nearly doubled their share of national income.

Comments

Post a Comment