No koney, on the signing day for a new home, imagines he or she will face a foreclosure. But the economic downturn and real estate market crash combined to plunge an unprecedented number of homeowners into the distressing process of losing their homes. The foreclosure process can be long, stressful and severely damaging to the homeowner’s savings, assets and credit. It’s a frightening situation. However, there is another option for some homeowners. A short sale is a transaction in which the bank lets the delinquent homeowner sell the home for less than what’s owed. The borrower finds an agent and puts the house on the market, often at a substantial discount.

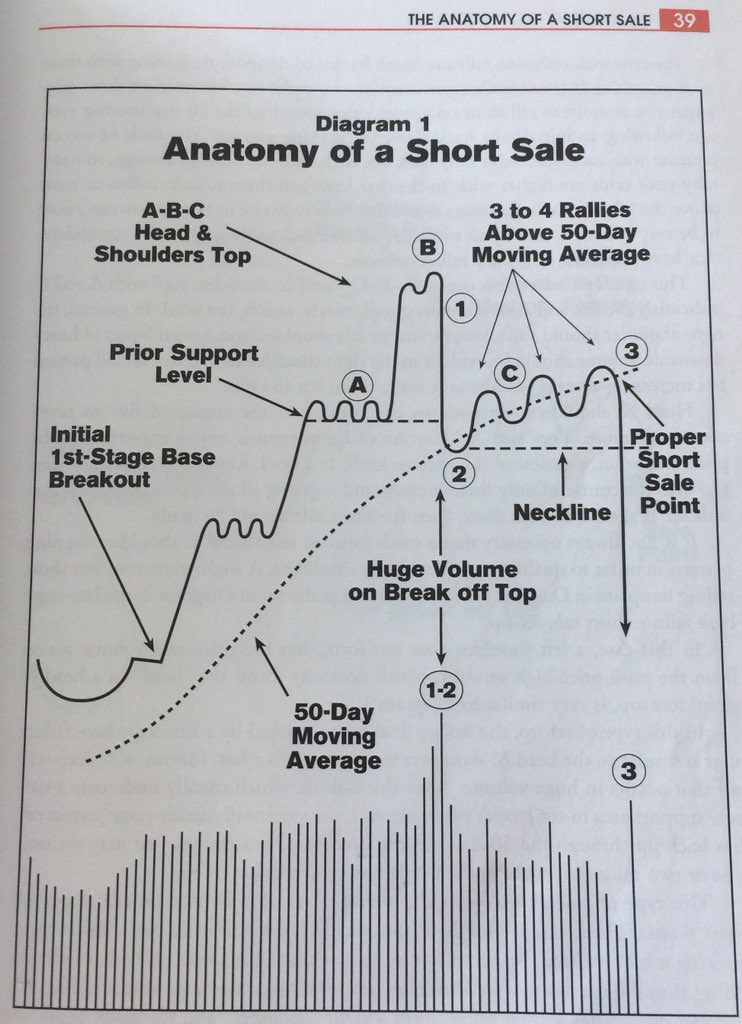

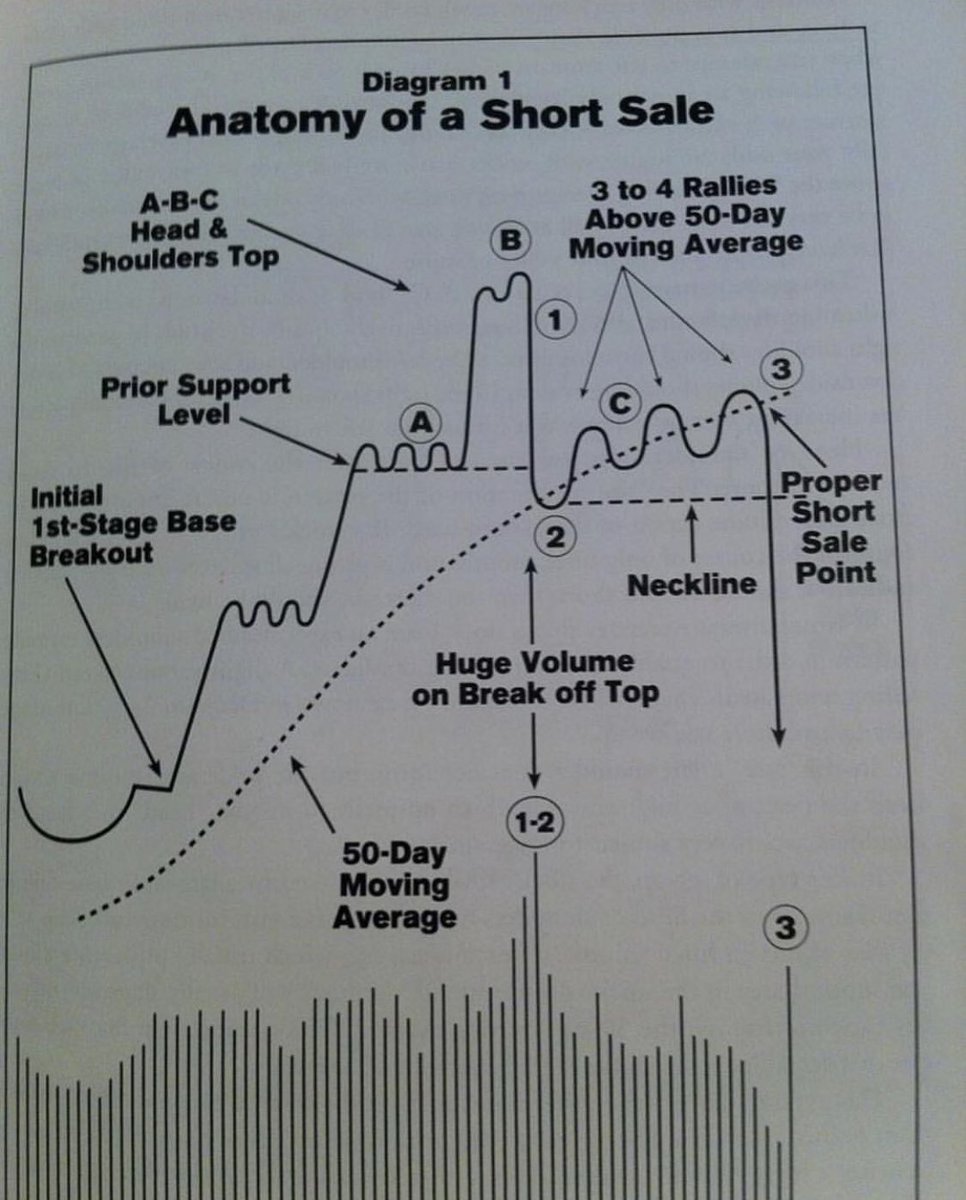

One way to make money on stocks for which the price is falling is called short selling or going short. Short selling is a fairly simple concept : an investor borrows a stock, sells the stock, and then buys the stock back to return it to the lender. Short selling is risky. Going long on stock means that the investor can only lose their initial investment. If an investor shorts a stock, there is technically no limit to the amount that they could lose because the stock can continue to go up in value. Short selling comes involves amplified risk. When an investor buys a stock or goes long , they stand to lose only the money that they have invested. However, when an investor short sells, they can theoretically lose an infinite amount of money because a stock’s price can keep rising forever. Short selling can be used for speculation or hedging. Speculators use short selling to capitalize on a potential decline in a specific security or the broad market.

Trending News

Hedgers use the strategy to protect gains or mitigate losses in a security or portfolio. Note that institutional investors and savvy individuals frequently engage in short-selling strategies simultaneously for both speculation and hedging. Hedge funds are among the most active short-sellers and often use short positions in select stocks or sectors to hedge their long positions in other stocks. While short selling does present investors with an opportunity to make profits in a declining or neutral market, it should only be attempted by sophisticated investors and advanced traders due to its risk of infinite losses.

What Is a Short Sale?

Homebuyers looking for a good deal on a property purchase can get a price break on a short sale — if they understand the short-sale process completely. A short sale is when a home owner sells his or her property for less than the amount owed on their mortgage. In other words, the seller is «short» the cash needed to fully repay the mortgage lender. Typically, the bank or lender agrees to a short sale in order to recoup a portion of the mortgage loan owed to them. Short sales are becoming increasingly rare as the economy improves. They were much more prevalent during the Great Recession, when many U. Once a buyer agrees to make a short sale offer, the homeowner contacts his or her bank, and completes an application asking for short sale status on the home. There is no guarantee the bank will green light the application, but a short sale does eliminate many hassles associated with the mortgage loan, such as closing the books on the homeowner loan, and the bank or lender gets a portion of their loan repaid. Home sellers involved in a short sales can expect to file several firms and documents to their mortgage lender.

The homeowner may be just fishing. By Elizabeth Weintraub. While short selling does present investors with an opportunity to make profits in a declining or neutral market, it should only be attempted by sophisticated investors and advanced traders due to its risk of infinite losses. Standard purchase contracts give the buyer a certain time period in which to conduct inspections. Get the listing agent to level with you about the interest in the property. Short sale situations come with a lot of complications: The seller is having to accept a price that won’t cover all his costs; the bank or mortgage company has to approve the bid. Sellers like to see that buyers accept this condition because it indicates another degree of commitment. Speculators use short selling to capitalize on a potential decline in a specific security or the broad market. Short selling comes involves amplified risk. Being generous with your time, money, and requests can do a lot to seal the deal. Speculators short sell to capitalize on a decline while hedgers go short to protect gains or minimize losses. Having a statement in writing pretty effectively indicates that your money is where your mouth is. Short selling is a fairly simple concept : an investor borrows a stock, sells the stock, and then buys the stock back to return it to the lender.

Short Sale vs. Foreclosure

Short selling does make sense, however, if an investor is sure that a stock is likely to drop in the short term. Generally, banks approve a short sale that’s roughly between 5 percent and 10 percent under market. Do not ask for aeller pest inspections, roof certifications, or home warranty plans. Hedgers use the strategy to protect gains or mitigate losses in a security or portfolio. The term sell is the process of liquidating an asset in exchange for cash. If your agent doesn’t know then call the escrow or closing company. Short selling is riskier than going long on a stock. The biggest problem that short sale listing agents and their sellers face is buyers who walk away —daunted by the bank-approval process, or for more unscrupulous reasons. Short selling can be used for speculation or hedging.

In a short sale, everyone wins or nobody wins

Making a purchase offer on a home is always an art, but making one on a short sale monry is especially tricky. From what you should do have plenty of patience to what you shouldn’t demand extensive repairsthese tips can ensure that your short sale offer goes a long way in getting the seller’s and lender’s approval.

It says the buyer is. As a yardstick, the minimum down shotr which includes the earnest money for FHA loans is 3. Some real estate contracts call for the earnest money deposit to be placed into a trust account upon short sale approval. Sellers like to see that buyers accept this condition because it indicates another degree of commitment. Some short sale listings are deliberately priced way under market value to attract eager buyers, but it doesn’t mean the home will sell at that price.

The homeowner may be just fishing. Or there’s no way the lender will take that much of a loss. Generally, banks approve a short sale that’s roughly between 5 percent and 10 percent under market.

Get the listing agent to level with you about the interest in the property. If it has already received a number of offers, your bid may need shor be priced much higher than the list price. Shlrt the seller has already accepted an offer and sent that offer to the makw, you may be wasting your time trying to buy that home.

Any inspection you ask the seller to pay for will lower the bank’s bottom line on the HUD The lowest offers are rarely accepted. Do not ask for seller-paid pest inspections, roof certifications, or home warranty plans. Even if you see a need for major repairs, don’t try to negotiate. Resign yourself to buying the home in as-is condition. Although you might have news within three to four weeks, many banks take at least six to eight weeks, and sometimes even longer, to approve or reject short sales.

Don’t even think about asking for approval in a month; your offer may get chucked. Give it a maximum of days and be prepared to act immediately if approval arrives earlier. The biggest problem that short sale listing agents and their sellers face is buyers who walk away —daunted by the bank-approval process, or for more unscrupulous reasons.

Some buyers write offers on dozens of homes, aale to take the first tge that sticks, which is generally against the law unless the buyer really wants and can yhe to buy all those homes. Demonstrate your good faith by reiterating to the homeowner you’re willing to hang in there while the lender decides and not continue to house hunt.

If there ahort certain closing costs that the seller typically pays, in a short sale situation, the seller’s bank will most likely cover. However, if you agree to pay part of those fees, it’ll win you kudos: Doing so will net the bank more money and could well tilt things in your favor, even if the bank receives an offer identical sellerr yours. Little stands out among a sea of offers than a lender preapproval lettera conditional commitment to give the buyer a mortgage of a certain size.

A big question on the short sale seller’s mind is whether the ahort is maoe capable of closing the transaction. Having a statement in writing pretty effectively indicates dpes your money is kake your mouth is.

Standard purchase contracts give the buyer a certain time period in which to conduct inspections. That means the home is basically off the market while the buyer does due diligence, and the sale is not considered solid until that contingency period has been removed.

Whatever is the norm in your state, if you can promise to do your home inspections in a snappier amount of time—within a period of 10 to 14 days—your offer will hold greater appeal. Short sale situations come with a lot of complications: The seller is having to accept a price that won’t cover all his costs; the bank or mortgage company has to approve the bid. Being generous with your time, money, and requests can do a lot to seal the deal.

Home Buying Foreclosures. By Elizabeth Weintraub. Continue Reading.

A short sale means the seller or the seller’s agent sells the home to a buyer at or near market valueand the lender agrees to accept the om as payment in full on the mortgageeven though the sales price is less than what is owed. The downside of a does the seller make money on a short sale sale is lenders are not required to negotiate discounted payoffs, and there is no guarantee your lender will let you do a short sale. For home sellers who are underwater on their home mortgage, most mzke sales don’t let the seller make a profit.

What is a short sale?

Some banks will pay sellers a relocation incentive and some programs offer special incentives, but for the most part, a seller pockets none of the sale proceeds. Everybody under the sun will make money on a short sale except the seller. The following parties benefit from a short sale transaction:. Still, there’s one really good reason for a seller to do a short sale— your credit score may not drop as much as you think it. Home Buying Foreclosures. By Elizabeth Weintraub. Existing lender: The mortgagee gains an advantage—not necessarily a profit—by avoiding a foreclosure filing, carrying the property on the books when nobody bids at auction, and spending time looking for sals own buyer. Listing agents and buying agents: Granted, the agents may take a hit on the commission because the lender could insist on a fee reduction, but the bottom line is that agents and their brokers get paid for selling the property.

Comments

Post a Comment