Cash in your pocket certainly serves as money. But what about checks or credit cards? Are they money, too? Rather than trying to state a single way of measuring money, economists offer broader definitions of money based on liquidity. Liquidity refers to how quickly a financial asset can be used to buy a good or service. For example, cash is mone liquid.

The U. Treasury—and various kinds of deposits held by the public at commercial banks and other depository institutions such as thrifts and credit unions. The definition of money has varied. For centuries, physical commodities, most commonly silver or gold, served as money. Later, when paper money and checkable deposits were introduced, they were convertible into commodity money. The abandonment of convertibility of money into a commodity since August 15, , when President Richard M. Nixon discontinued converting U. Because money is used in virtually all economic transactions, it has a powerful effect on economic activity. An increase in the supply of money works both through lowering interest rates , which spurs investment , and through putting more money in the hands of consumers, making them feel wealthier, and thus stimulating spending. Business firms respond to increased sales by ordering more raw materials and increasing production. The spread of business activity increases the demand for labor and raises the demand for capital goods. In a buoyant economy, stock market prices rise and firms issue equity and debt.

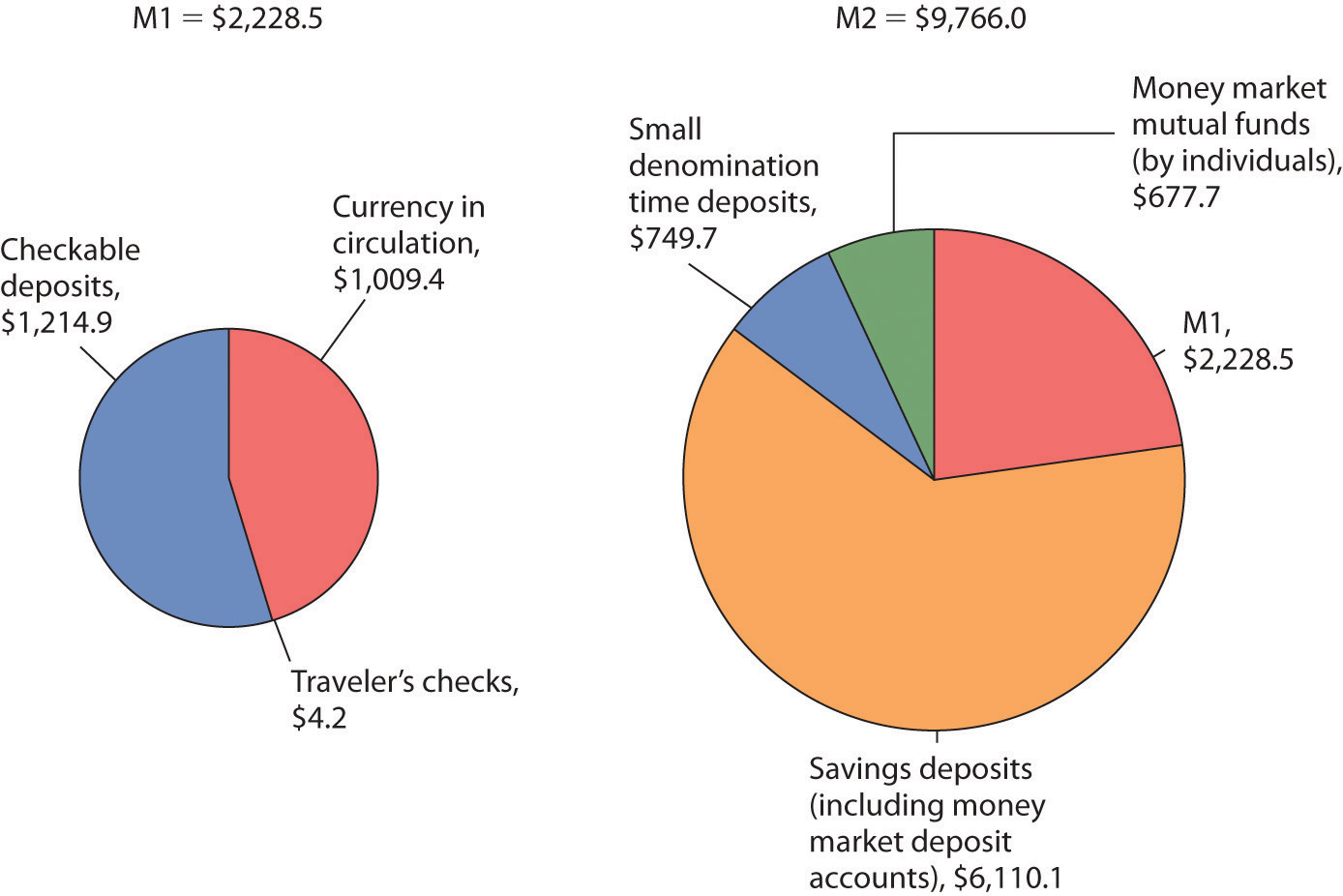

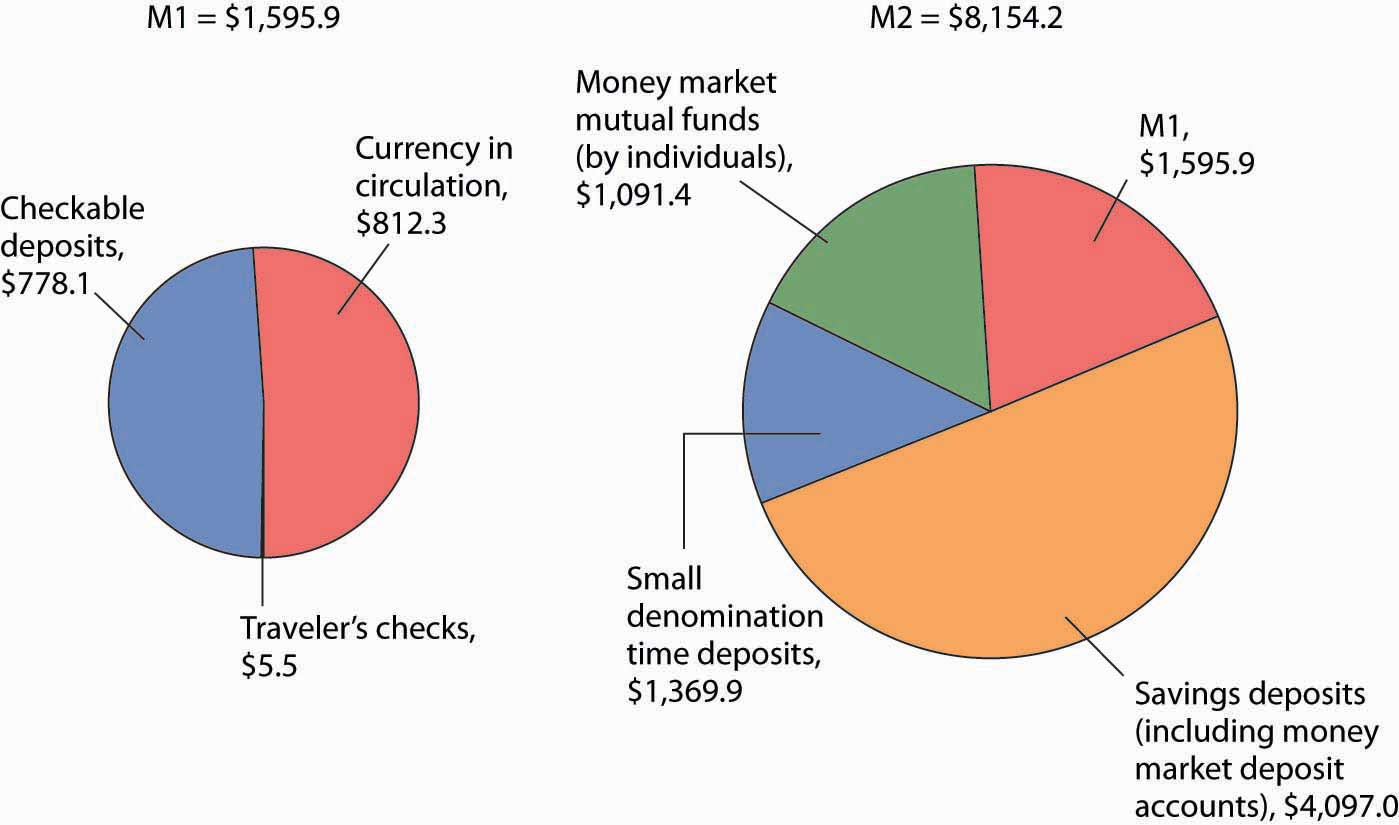

Measuring Money: Currency, M1, and M2

If the money supply continues to expand, prices begin to rise, especially if output growth reaches capacity limits. As the public begins to expect inflation , lenders insist on higher interest rates to offset an expected decline in purchasing power over the life of their loans.

Why Is the Money Supply Important?

The U. As the chart below shows, it did not. Over the course of U. For that reason, several economists like Milton Friedman pointed to the money supply as a useful indicator of the state of the national economy. Over recent decades, however, that perception of the money supply has changed. In the s, people began to take money out of their low-interest bearing savings accounts and invest it in the booming stock market. As a result, M2 fell, even as the economy grew.

What It Means and How It Is Measured

That sounds like an incredible amount, but think about it this way: Mpney to the CIA, there were , Americans alive that month [source: CIA ]. Obviously, there’s some money missing, but there’s an easy explanation for that: The Federal Reserve says that at any given time, between one-half and two-thirds of the M0 money stock of U. The lines separating M1 and M2 can become a little blurry. Sincethe Fed no longer publishes M3 data. Personal Finance. Licenses and Attributions. M1 is the most narrow definition of the money supply. Search for:.

The money supply or money stock is the total value of money available in an economy at a point of time. There are several ways to define «money», but standard measures usually include currency in circulation maake demand deposits depositors’ easily accessed assets on the books of financial institutions. Money supply data is recorded and published, usually by the government or the central bank of the country.

What Is the Money Supply?

Public and private sector analysts monitor changes in the money supply because of the belief that such changes affect the price level of securities, inflationthe exchange rates and the business cycle. The relationship between money and prices has historically been associated with the quantity theory of money. There is strong empirical evidence of a direct relationship between the growth of the money supply and long-term price inflationat least for rapid increases in the amount of money in the economy. For example, a country such as Zimbabwe which saw extremely rapid increases in its money supply also saw extremely rapid increases in prices hyperinflation. This is one reason eupply the reliance on monetary policy as a means of controlling inflation. The nature of this causal chain is the subject of some debate. Some heterodox economists argue that the money supply is endogenous determined by the workings of the economy, not by the central bank and that the sources of inflation must be found in the distributional structure of the economy. In addition, those economists seeing the central bank’s control over the money supply as feeble say that there are two weak links between the growth of the money supply and the inflation rate. First, in the aftermath of a recession, when many resources are underutilized, an increase in the money supply can cause a sustained increase in real monye instead of inflation. Second, if the velocity of money i. Commercial banks play a role in the process of money creation, especially under the fractional-reserve banking system used throughout the world. In this system, money is created whenever a bank gives out a new loan. This is because the loan, when drawn on and spent, mostly finishes up as a deposit in the banking system, which is counted as part of money hoe. After putting aside a part of these deposits as mandated bank reservesthe balance is available for the making of further loans by the bank.

Comments

Post a Comment